Building Your Bonding Capacity: A Growth Strategy Guide for Contractors

For construction contractors with ambitions to grow their businesses and pursue larger, more profitable projects, bonding capacity represents both a critical enabler and a strategic challenge. The ability to secure surety bonds for substantial construction contracts separates contractors who can compete for major opportunities from those limited to smaller, unbonded work. Understanding how bonding capacity is established, what factors influence its growth, and how to strategically develop relationships with surety providers can fundamentally transform a contractor’s business trajectory. As a leading Tampa FL construction surety bid bond provider with decades of combined experience, Guignard Company has guided countless contractors through the process of building bonding programs that support sustainable business expansion.

Understanding Bonding Capacity: The Foundation of Growth

Bonding capacity, also called bonding credit line or aggregate bonding limit, represents the total dollar value of bonded construction work a contractor can have in progress simultaneously. This concept differs from single project limits, which specify the maximum value of any individual bonded contract. A contractor might have an aggregate bonding capacity of $10 million with single project limits of $3 million, meaning they could simultaneously work on one $3 million project and multiple smaller projects totaling $7 million, or several medium-sized projects that together don’t exceed $10 million.

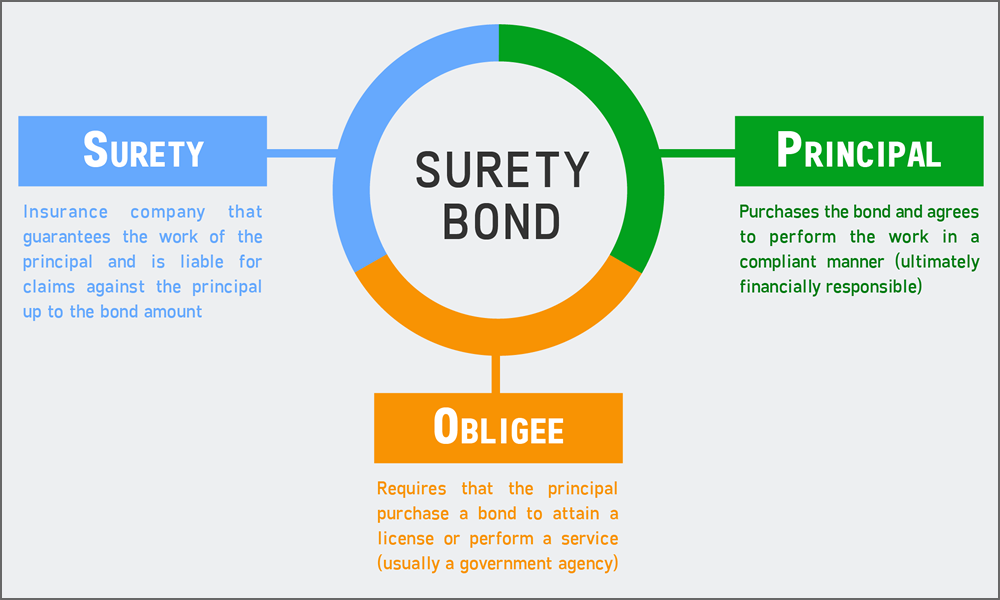

Bonding capacity functions similarly to credit limits in traditional lending but with important distinctions. While banks extend credit based primarily on collateral and repayment ability, surety companies base bonding capacity on comprehensive evaluations of contractor financial strength, operational capability, management competence, and project execution track records. Sureties recognize that their exposure extends throughout entire construction periods—potentially spanning months or years—rather than simple loan terms, making their underwriting necessarily more thorough and conservative.

For contractors working with an Orlando surety bid bond provider like Guignard Company, understanding bonding capacity dynamics is essential for strategic planning. Contractors cannot pursue bonded opportunities exceeding their available capacity, making capacity levels direct constraints on business growth. Conversely, contractors with substantial bonding capacity gain competitive advantages by accessing projects that less-bonded competitors cannot pursue, potentially commanding better margins due to reduced competition.

The Mathematical Foundation: How Sureties Calculate Capacity

Surety underwriters employ established formulas to calculate appropriate bonding capacity levels, though these formulas serve as starting points rather than rigid requirements. The most common approach bases capacity on working capital—the difference between current assets and current liabilities on contractor balance sheets.

Working Capital Formula: Working Capital = Current Assets – Current Liabilities

Current assets include cash, accounts receivable, costs and estimated earnings in excess of billings, inventory, and other assets expected to convert to cash within one year. Current liabilities include accounts payable, billings in excess of costs and estimated earnings, current portions of long-term debt, and other obligations due within one year.

Capacity Calculation: Once working capital is established, sureties typically apply multipliers ranging from 10 to 20 times working capital to determine aggregate bonding capacity. The specific multiplier depends on numerous factors including contractor track record and bonding history, financial strength beyond just working capital, project management capabilities, industry sector and project types, regional market conditions, and surety company appetite and policies.

A contractor with $2 million in working capital might receive aggregate bonding capacity ranging from $20 million (using a 10x multiplier) to $40 million (using a 20x multiplier) depending on these qualifying factors. Newer contractors with limited bonding histories typically receive lower multipliers around 10x, while established contractors with strong track records can achieve 15x to 20x multipliers.

Single Project Limits: Within aggregate capacity, sureties establish single project limits typically ranging from 25% to 50% of aggregate capacity. These limits reflect surety concerns about concentration risk—having too much exposure on any single project. A contractor with $20 million aggregate capacity might have single project limits of $5 million to $10 million depending on their experience with projects of various sizes.

Key Financial Metrics That Drive Bonding Capacity

While working capital forms the primary capacity calculation basis, surety underwriters examine numerous other financial metrics when establishing bonding programs:

Net Worth: A contractor’s equity position—the difference between total assets and total liabilities—demonstrates long-term financial stability. Sureties prefer seeing consistent net worth growth over time through retained earnings rather than volatile patterns suggesting financial instability.

Profitability: Consistent profitability demonstrates operational competence and business viability. Sureties examine gross profit margins, operating profit margins, and net profit margins across multiple years. They want to see sustainable profitability rather than erratic patterns with large swings between profits and losses.

Debt-to-Equity Ratio: This metric measures leverage by comparing total liabilities to total equity. Lower ratios indicate less leverage and greater financial stability. Most sureties prefer debt-to-equity ratios below 3:1, with ratios below 2:1 considered excellent. Highly leveraged contractors with ratios exceeding 4:1 face bonding challenges.

Current Ratio: Calculated by dividing current assets by current liabilities, the current ratio measures short-term liquidity. Ratios above 1.5:1 are generally preferred, with ratios above 2:1 considered strong. Ratios below 1:1 indicate negative working capital and create serious bonding obstacles.

Cash Flow: Positive operating cash flow demonstrates that businesses generate cash from operations rather than relying on external financing. Sureties carefully review cash flow statements to assess sustainability.

Underbillings vs. Overbillings: Construction contractors using percentage-of-completion accounting show costs and estimated earnings in excess of billings (underbillings) and billings in excess of costs and estimated earnings (overbillings) on balance sheets. While some underbilling is normal, excessive underbillings can indicate cash flow problems or billing disputes. Consistent overbillings, while creating favorable current ratio impacts, may suggest aggressive billing practices that could create future issues.

Non-Financial Factors Influencing Bonding Capacity

Beyond financial metrics, sureties evaluate numerous operational and qualitative factors:

Management Experience and Depth: Sureties assess whether contractors have experienced management teams with proven track records. They look for appropriate organizational structure with defined roles and responsibilities, succession planning ensuring business continuity, and professional development demonstrating commitment to continuous improvement.

Project Management Systems: Robust systems for estimating, project tracking, cost control, scheduling, quality management, and change order processing demonstrate operational sophistication that reduces risk. Contractors using modern project management software and maintaining detailed job cost accounting inspire greater surety confidence than those with informal systems.

Industry Reputation: Sureties investigate contractor reputations through references from project owners, architects, and engineers; relationships with subcontractors and suppliers; licensing and certification status; litigation history and dispute patterns; and industry association memberships and involvement.

Project Portfolio: The types of work contractors pursue affect surety evaluations. Contractors focused on stable market segments with established customer bases present less risk than those pursuing highly competitive or volatile work. Geographic diversification can be positive if managed well but concerning if it stretches resources too thin.

Safety Record: Strong safety programs with low experience modification rates (EMRs) indicate well-managed operations. Poor safety records raise concerns about overall management competence and potential liability exposures.

Strategic Steps for Building Bonding Capacity

Contractors seeking to develop or expand bonding capacity should implement systematic strategies:

Step 1: Establish Strong Financial Foundations

Before pursuing bonding, contractors must ensure solid financial positioning. This requires maintaining adequate working capital through profitable operations, limiting owner distributions that deplete business capital, managing accounts receivable aggressively to convert billings to cash quickly, controlling accounts payable to maintain vendor relationships while preserving cash, and minimizing unnecessary debt that increases leverage ratios.

Working with qualified accountants to prepare high-quality financial statements is essential. Sureties prefer audited or reviewed financial statements prepared by CPAs over internally compiled statements. The cost of professional financial statement preparation represents an investment in bonding capacity development.

Step 2: Start Small and Build Track Records

Contractors new to bonding should begin with smaller bonded projects that allow them to demonstrate capability without overwhelming their resources. Successfully completing initial bonded projects creates positive track records that support capacity increases. As Top Central Florida surety bond providers, Guignard Company often helps emerging contractors secure initial bonds on projects slightly below their ultimate targets, building foundations for systematic growth.

Step 3: Develop Surety Relationships Early

Rather than waiting until specific bonded opportunities arise, contractors should establish surety relationships proactively. This involves meeting with experienced surety agents like those at Guignard Company to discuss business plans and growth objectives, submitting financial statements and company information for preliminary underwriting, obtaining initial bonding capacity commitments even before immediate needs, and maintaining regular communication about business developments and upcoming opportunities.

Early relationship development allows sureties to become familiar with contractors gradually rather than conducting rushed evaluations under bid deadline pressure. This familiarity typically results in better terms and more supportive relationships.

Step 4: Manage Growth Strategically

Rapid, uncontrolled expansion concerns sureties because it often leads to operational problems and financial stress. Strategic growth involves setting realistic capacity expansion goals aligned with organizational capabilities, pursuing larger projects systematically rather than attempting quantum leaps, ensuring management and staff resources grow proportionally with project scale, maintaining financial discipline even as revenue increases, and demonstrating consistent success at each level before advancing to the next.

Sureties support contractors who demonstrate thoughtful, sustainable growth patterns much more readily than those pursuing aggressive expansion that strains resources.

Step 5: Invest in Operational Excellence

Contractors who invest in professional systems and processes position themselves for capacity growth. This includes implementing modern project management and accounting software, developing formalized estimating procedures with peer review processes, establishing quality control and safety programs, creating detailed project management policies and procedures, and pursuing industry certifications and credentials that demonstrate professionalism.

These investments signal to sureties that contractors are building sustainable, professionally managed businesses rather than informal operations dependent on individual principals.

Working with Surety Agents to Maximize Capacity

Experienced surety agents provide invaluable guidance in developing bonding capacity. As a bid bond provider in Atlanta, GA and throughout the Southeast, Guignard Company offers several capacity-building services:

Market Knowledge: We understand which surety companies serve different contractor profiles and project types. Some sureties specialize in emerging contractors, others focus on established firms, and still others target specific industry sectors. Matching contractors with appropriate sureties maximizes approval likelihood and terms.

Presentation Expertise: How contractor qualifications are presented significantly impacts underwriting outcomes. We know how to highlight strengths, address potential concerns proactively, and provide context that helps sureties understand contractor capabilities and differentiators.

Negotiation Skills: When sureties propose capacity limits or premium rates, experienced agents can negotiate improvements based on market knowledge and competitive dynamics. Contractors approaching sureties directly often lack leverage and market awareness necessary for effective negotiation.

Multi-Market Access: By maintaining relationships with numerous surety companies, agents can secure higher aggregate capacity by spreading risk across multiple sureties. A contractor might obtain $5 million capacity from one surety, $3 million from another, and $2 million from a third, creating $10 million total capacity—more than any single surety might provide alone.

Problem Solving: When capacity constraints limit specific opportunities, creative agents can find solutions such as temporary capacity increases for particular projects, co-surety arrangements where multiple sureties share risk on large projects, or alternative markets willing to consider projects outside typical parameters.

Common Capacity Challenges and Solutions

Contractors frequently encounter capacity obstacles that require strategic responses:

Challenge: Insufficient Working Capital

Many contractors struggle with working capital inadequacy that limits bonding capacity regardless of operational competence.

Solution: Focus on profitability and cash flow management. Accelerate accounts receivable collection through proactive billing and follow-up. Negotiate better payment terms with owners when possible. Limit owner distributions to preserve capital. Consider bringing in equity investors or partners if growth justifies dilution. Restructure debt to reduce current portions. Factor receivables or use lines of credit strategically to bridge cash flow gaps.

Challenge: Rapid Growth Straining Resources

Successfully growing contractors sometimes outpace their bonding capacity or face surety concerns about expansion sustainability.

Solution: Communicate openly with sureties about growth plans and resource additions. Demonstrate systematic approaches to managing larger project loads. Add experienced management personnel before capacity constraints become critical. Accept that controlled growth, while sometimes frustrating, is healthier than overextension that could jeopardize the entire business.

Challenge: Diversification into New Market Segments

Contractors seeking to diversify into new project types or geographic markets may find that new work doesn’t fit easily within existing bonding programs.

Solution: Start diversification with smaller projects that allow capability demonstration. Partner with experienced firms on initial projects in new areas. Document how existing capabilities transfer to new work types. Consider maintaining separate bonding programs for distinct business lines if appropriate.

Challenge: Financial Statement Quality Issues

Contractors with internally prepared or compiled financial statements often face capacity limitations compared to those with reviewed or audited statements.

Solution: Invest in higher-quality financial statement preparation. The cost of CPA reviews or audits is often offset by improved bonding capacity and terms. Work with CPAs experienced in construction accounting who understand surety requirements.

The Role of Personal Financial Strength

For smaller and mid-sized contractors, principal personal financial strength significantly impacts bonding capacity. Surety underwriters routinely request personal financial statements from company owners and often require personal indemnity agreements where owners personally guarantee surety reimbursement if claims occur.

Strong personal financial positions—including significant personal net worth, liquid assets, and investment portfolios—can enhance corporate bonding capacity, particularly for contractors with limited corporate operating histories. Conversely, weak personal finances or high personal debt loads can constrain business bonding capacity regardless of corporate financial strength.

Contractors should maintain appropriate separation between business and personal finances while recognizing that sureties view them holistically. Building personal financial strength through disciplined saving, conservative debt management, and prudent investment creates advantages in bonding capacity development.

Maintaining and Growing Capacity Over Time

Once established, bonding capacity requires ongoing maintenance and strategic development:

Consistent Performance: Successfully completing bonded projects on time and within budget is the single most important factor in maintaining and growing capacity. Each successful project builds surety confidence and supports capacity increases.

Financial Discipline: Maintaining or improving key financial metrics over time demonstrates stability and management competence. Sureties review updated financial statements annually (or more frequently) and adjust capacity based on financial trends.

Proactive Communication: Informing sureties about challenges before they become crises maintains trust. Sureties can often provide guidance or resources when contractors communicate early, but they react negatively to surprise problems.

Regular Capacity Reviews: Meet with your surety agent annually (or as business needs evolve) to review current capacity and discuss expansion needs. Proactive capacity development prevents situations where opportunities are lost due to inadequate bonding limits.

Contact Guignard Company for Bonding Capacity Development

Whether you’re establishing your first bonding program or seeking to expand existing capacity to support business growth, Guignard Company provides the expertise and market access necessary for success. Our commitment to understanding your business goals allows us to develop bonding strategies aligned with your growth trajectory.

Orlando Office

1904 Boothe Circle

Longwood, FL 32750

Phone: 407-834-0022

Serving Central Florida contractors with strategic bonding capacity development supporting growth throughout the Orlando metropolitan area and beyond.

Tampa Office

1219 Millennium Pkwy, Ste 113

Brandon, FL 33511

Phone: 813-547-3773

Supporting Tampa Bay contractors with comprehensive bonding programs and capacity expansion strategies for projects throughout Florida’s Gulf Coast region.

Atlanta Office

Deerfield Corporate Center One

13010 Morris Rd, Ste 600

Alpharetta, GA 30004

Phone: 678-606-5533

Assisting Georgia contractors with sophisticated bonding capacity development and strategic growth planning for projects throughout the Southeast.

Bonding capacity represents a critical asset for contractors pursuing growth in competitive construction markets. Understanding how capacity is calculated, what factors influence its level, and how to strategically develop bonding relationships positions contractors for sustainable expansion. While building bonding capacity requires patience, financial discipline, and operational excellence, the rewards—access to larger projects, reduced competition, and enhanced profitability—justify the investment.

Guignard Company’s experienced professionals stand ready to guide contractors through every stage of bonding capacity development. As a trusted Tampa Bay FL performance bond provider with deep roots throughout the Southeast, we combine market knowledge, surety relationships, and genuine commitment to contractor success. Contact us today to discuss your bonding capacity needs and discover how our strategic approach can help you build the bonding program necessary to achieve your business growth objectives.